Visa Cross-Border Solutions

Putting the power of cross-border money movement in your hands.

People transfer, convert and collect money across borders for a reason

It’s always been urgent. It’s always been about trust. And yet, it’s always been difficult. Complex, costly, opaque and slow. And for no good reason. Visa Treasury as a Service (TaaS) removes barriers, brings transparency and transcends borders for you. Empowering you to achieve more.

Transcend borders effortlessly with Visa Cross-Border Solutions

A frictionless, simple, cost-effective cross-border experience, anywhere you pay and get paid.

Innovations to help you go global

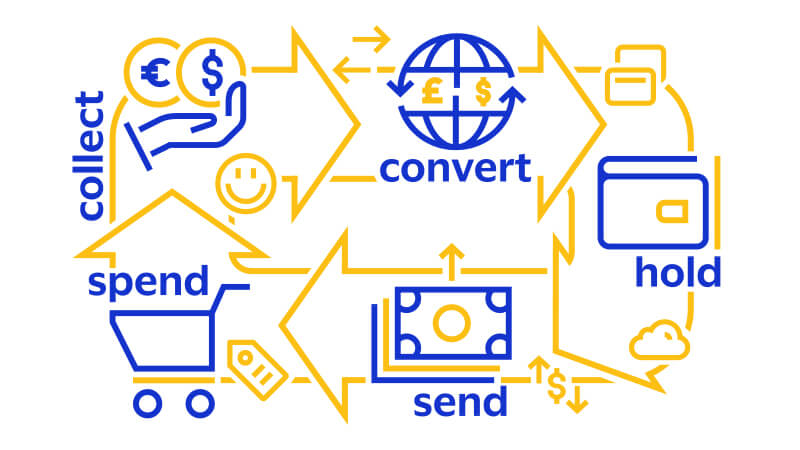

Our cloud-native platform puts the power of global money movement in your hands - making it easier for your customers to collect, hold, convert and send and spend money in multiple currencies.

Empowering you to achieve more

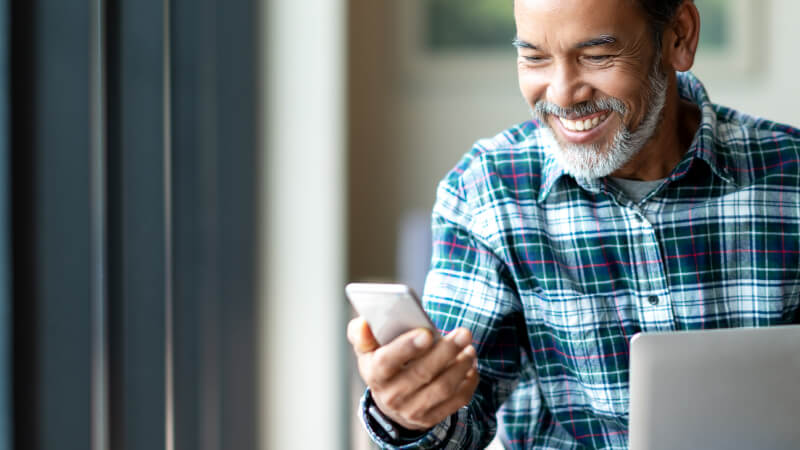

We are driven to serve you, our customers, providing you with tailored solutions so you can have the scalable, borderless business that you’ve always wanted.

We get you there faster

Our global reach and modular approach make it easier for you to get your products in the hands of your customers quickly and help them send and spend money in 180+ territories.

Trust, embedded in every transaction

We help you scale, shouldering the compliance, regulation and enterprise-grade security you need to thrive in a global market.

Benefits of working with Visa Cross-Border Solutions

Multi-currency wallets

Embedded finance

Global reach

Speed to market

Empowering cross-border worldwide

Banks, fintechs, brokers and businesses worldwide are already benefiting from Visa Cross-Border Solutions. Explore here how they are leveraging its capabilities to reduce barriers and costs and improve the cross-border money movement experience – to give compelling customer service and accelerate their international growth.

Put the power of money movement in your hands

See how Visa Cross-Border Solutions can start enabling your cross-border ambitions today.